Are Stablecoins Saving the U.S. Treasury Market?

US bonds, long considered a bastion of financial stability, have experienced a significant downturn. The iShares 20 Plus Year Treasury Bond ETF ($TLT) illustrates this trend with a 22% decline over the past five years and a nearly 50% drop since its 2020 peak. This dramatic shift raises critical questions about the stability and future of traditional safe-haven assets.

The underlying issue plaguing the US Treasury market is a classic economic scenario: an imbalance in supply and demand. As Liz Hoffman of Semafor reports, U.S. Treasury bonds are facing their worst period since the Civil War. Exacerbating the situation is the government’s increasing borrowing to finance deficits, coupled with a noticeable pullback from traditional buyers. The result is a demand for higher yields and underwhelming bond auctions, leading to significant losses in bond portfolios.

A Changing International Dynamic

Traditionally, countries like China and Japan have been steadfast investors in US Treasuries. However, over the past decade, their combined holdings have plummeted by about 68%. This retreat is part of a broader global realignment, where traditional nation-state investors are scaling back their investments in US government bonds.

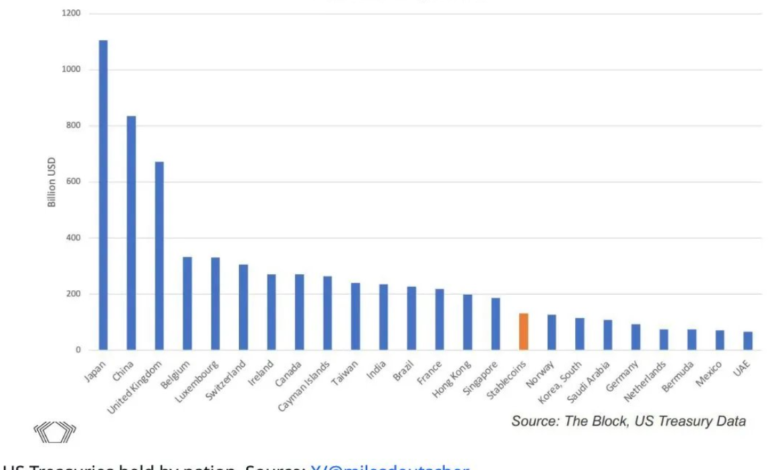

In this environment of declining traditional investment, an unexpected player has emerged: stablecoin issuers. These digital asset entities have rapidly become significant holders of US Treasuries, now ranking as the 16th largest group of investors. Their holdings surpass those of several major countries, signaling a notable shift towards digital fiat currencies in the Treasury market.

Predicting the New Normal

Despite the shift, Japan and China remain the largest holders of US Treasuries. However, the trend points towards a future increasingly influenced by fiat stablecoin issuers. This trend indicates a potential digital disruption in the Treasury market, underscoring the evolving nature of global finance.

The increasing influence of stablecoin issuers in the Treasury market may seem surprising today, but reflects the rapid evolution of the financial landscape. This trend may lead to stablecoin issuers becoming the largest holders of US Treasuries in the next decade, a scenario that seemed improbable just a few years ago. As the market continues to evolve, the role of digital assets in traditional finance becomes increasingly significant, potentially reshaping the Treasury landscape in ways yet to be fully understood.

(@APompliano)

(@APompliano)